secretarial fee tax deduction malaysia 2018

A 336 are revoked. He was also Past President of the.

Newsletter 27 2017 Wht On Income Of A Non Resident Public Entertainer Page 002 Jpg

All price above will subject to Malaysia Service Tax at 6 commencing 1 September 2018.

. Tax and Secretarial Fee Tax Deduction Malaysia 2020 dated on 31122020. A non-refundable processing fee of 1000 is requiredIn addition a convenience fee of 300 is required to process payment if paying online and using a creditdebit card. Guide to Imported Services for Service Tax.

SST Treatment in Designated Area and Special Area. The new 2020 Rules are effective from YA. Section 19 of the Tourism Tax Act 2017.

India follows a parliamentary system in which the prime minister is the presiding head of the government and chief of the executive of the government. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions. To encourage Malaysian resident individuals to rent out residential homes at reasonable charges Malaysia budget 2018 announced that 50 income tax exemption be given on rental income received by Malaysian resident individuals in year of assessment 2018 subject to the following conditions.

SST Treatment in Designated Area and Special Area. On Friday 23 September UK Chancellor of the Exchequer announced his Mini Budget unveiling his Growth Plan to release the huge potential in the British economy by tackling high energhy costs and infoamtion and. Get 247 customer support help when you place a homework help service order with us.

We would like to show you a description here but the site wont allow us. Resident individual shareholder whose total dividend income in a financial year exceeds 5000 and who wish to receive dividend without deduction of tax at source may submit a declaration in Form No. The system is thus based on the taxpayers ability to pay.

Digital Service Tax in Malaysia. I hereby declare that the information given above is true correct to the best of my knowledge belief. Malaysia Service Tax 2018.

No tax shall be deducted at source on payment of dividend not exceeding 5000 to a resident individual shareholder. Malaysia Sales Tax 2018. Section 26 of the Sales Tax Act 2018.

Section 19 of the Tourism Tax Act 2017. Seamaster Chronostop model reference 145008. Section 26 of the Service Tax Act 2018.

Special Tax Deduction For Rental Reduction. TTCS was founded by Mr SM Thanneermalai in 2018 with a mission to help businesses manage their tax affairs and resolve any tax related matters with the tax authorities. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Arts and Culture Malaysia MOTAC. Section 19 of the Departure Levy Act 2019. ASCII characters only characters found on a standard US keyboard.

Semua harga di atas akan dikenakan Cukai Perkhidmatan Malaysia pada 6 bermula 1 September 2018. Lembaga Hasil Dalam Negeri Malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan. CHANCELLOR OF THE EXCHEQUER KWASI KWARTENG ANNOUNCES NEW GROWTH PLAN WITH BIGGEST PACKAGE OF TAX CUTS IN GENERATIONS.

Package Fee for Withholding Tax Services in Malaysia. Withholding Tax Services in Malaysia. Large 41 mm steel case.

There are special rules for deduction of certain expenses for example interest expenses and special tax relief is available for certain capital expenditure for Hong Kong Company. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make. 6 to 30 characters long.

Year of manufacture 1969. Ways To Pay For Sales And Services Tax SST In Malaysia. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

Indirect tax advisory and tax compliance services. Entrance fee to tourist attractions. With this the Income Tax Deduction for Expenses in relation to Secretarial Fee and Tax Filing Fee Rules 2014 PU.

Dimaklumkan bahawa Hasilian Research Snapshot HRS Bil. In such systems the head of state or the head of states official representative ie the monarch president or governor-general usually holds a purely ceremonial position and actson most mattersonly. The steel bracelet is also original from the time and.

The accumulated unabsorbed losses up to the year of assessment 2018 that can be carried forward till the year of assessment 2025 is extended until the year of assessment 2028. Malaysia Service Tax 2018. Browse our listings to find jobs in Germany for expats including jobs for English speakers or those in your native language.

Factors Influencing the Intention to Use Monthly Tax Deduction As Final Tax Among Employees in Bangi Malaysia kini boleh didapati di Portal. Tax Deductible Expenses for Hong Kong Companies. How to Check SST Registration Status for A Business in Malaysia.

Must contain at least 4 different symbols. Malaysia Sales Tax 2018. Read our past blog on the special tax deduction on secretarial and tax filing fee.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Section 26 of the Sales Tax Act 2018 Section 26 of the Service Tax Act 2018 Section 19 of the Departure Levy Act 2019. Rare collectible rarity in perfect condition Service 2018 Extremely rare collectors watch from Omega.

The withholding tax deduction is made or paid after the due date for the furnishing of an Income Tax Return Form for a.

Newsletter 65 2018 Withholding Tax On Special Classes Of Income Page 001 Jpg

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Your Tax Advisor S Guide To The Inflation Reduction Act

Qm23cz2xk8bkrwe9yy Author At Klm Group Accounting Company Secretarial Taxation Audit Kuala Lumpur

Amended Guidelines On Deductions For Secretarial Fees And Tax Filing Fees Ey Malaysia

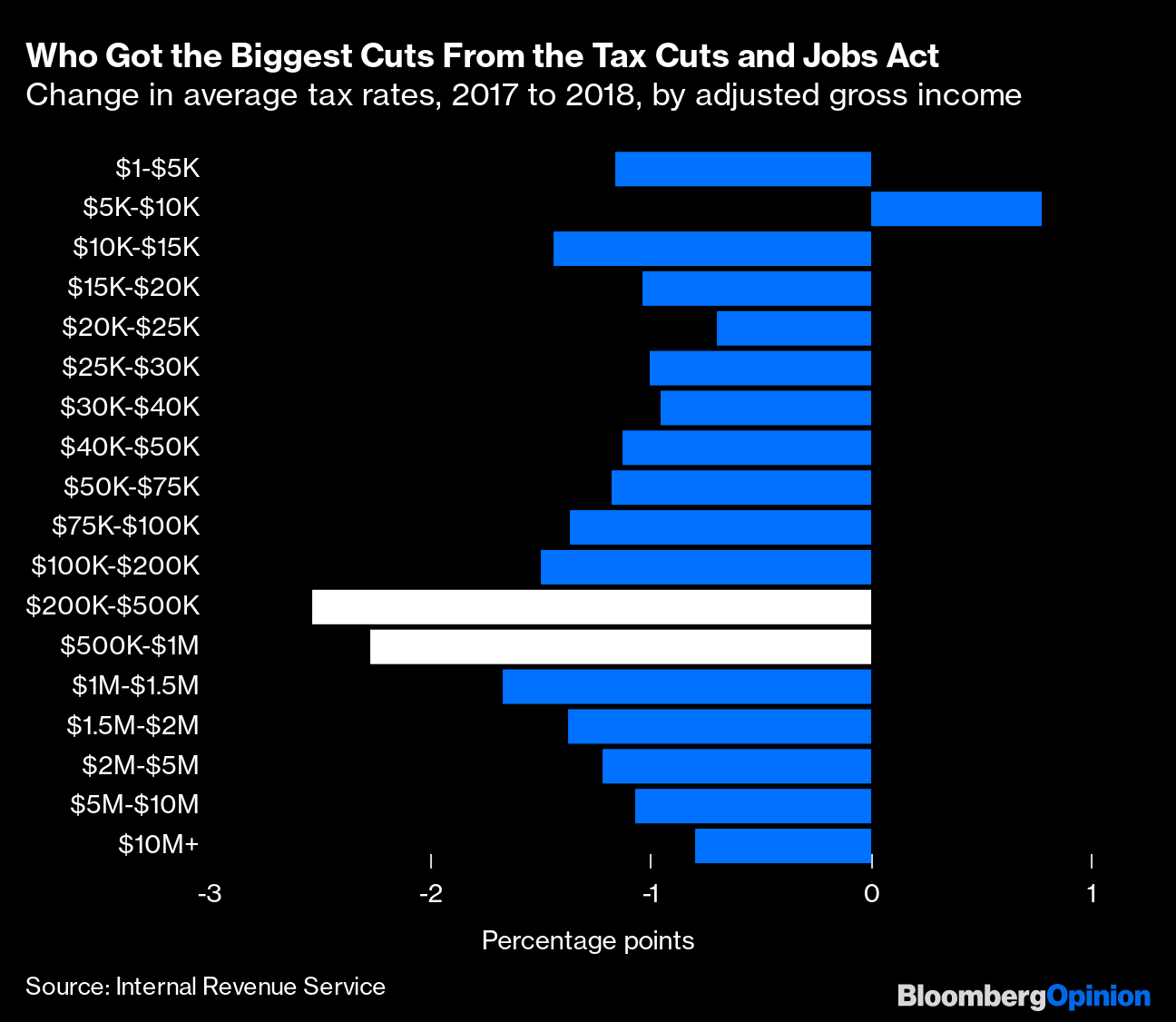

Trump S Tax Cut Was Very Good To The 200 000 To 1 Million Set Bloomberg

Individual Tax Relief For Ya 2018 Kk Ho Co

Newsletter 40 2019 Income Tax Deductions For The Employment Of Disabled Persons Amendment Rules 2019 Page 001 Jpg

Visualization Of Tax Avoidance And Tax Rate Convergence Exploratory Analysis Of World Scale Accounting Data Emerald Insight

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Equal Housing Lender Poster U S Government Bookstore

Colorado S Pass Through Entity Tax Now Retroactive To 2018 Crowe Llp

Tax Deduction Of Secretarial Fees And Tax Filing Fees

3 21 3 Individual Income Tax Returns Internal Revenue Service

Form 1116 Foreign Tax Credit Here S What You Need To Know Htj Tax

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

3 21 3 Individual Income Tax Returns Internal Revenue Service

3 21 3 Individual Income Tax Returns Internal Revenue Service

Comments

Post a Comment